Analysis on Imports and Exports of India

by theDatatalks . 17 Feb 2019Introduction

The objective of this analysis is to measure the impact on Import/Export

value due to change in various factors like GDP, Exchange rate (currency

inflation), inflation, trade policies, foreign currency reserves,

demand, trade deficit, countries current account, quality, productivity

& labor cost.

Out of all variables we have taken the below variables for which we have

measurable data

- Exchange rate

- Trade deficit

- Foreign currency reserve

Data source for this analysis

https://commerce.gov.in/

https://m.rbi.org.in/

The required values are in various sub-pages of the above-mentioned websites and

we have manually copied the values of below said data variables into a

*.CSV file. This file can be downloaded from Imports & Exports of India

Data Variables:

Data for this analysis has below variables

- Year - End of the financial year - Example the year 1998 represents the

financial year of 1997-98 - Import.INR.lacs. - Total import value in “lacs INR”

- Import.USD.millions. - Total import value in “million USD”

- Export.INR.lacs. - Total Export value in “lacs INR”

- Export.USD.millions. - Total export value in “million USD”

- Exchange.rate - Exchange rate (Calculated based on export INR & USD

values) - Trade.deficit.INR.lacs. - Import less export in “lacs INR”

(Calculated as import less export) - Trade.deficit.USD.millions. - Import less export in “million USD”

(Calculated as import less export) - FC.Reserve.INR.lacs. - Foreign currency reserve in “lacs INR”

- FC.Reserve.USD.millions. - Foreign currency reserve in “million USD”

All above USD & INR values are reported values in the current price.

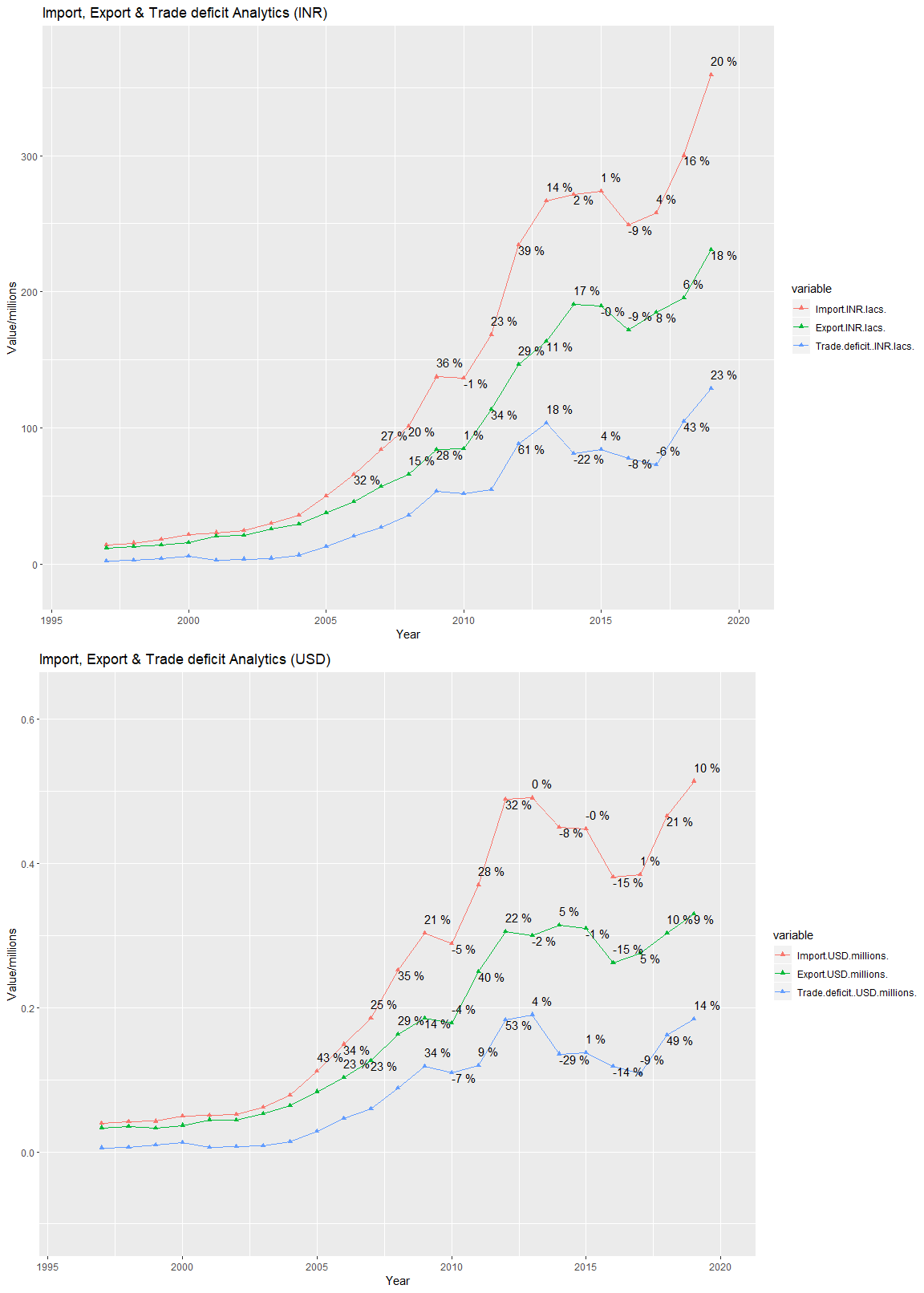

Analysis 1: Representation of Import, Export & Trade Deficit

The below chart is a representation of import, export & trade deficit in

a single line chart. We have a separate chart for INR & USD values. The

percentage values mentioned above each point are the “positive growth”/“negative growth” from the

previous year value.

- The change in Import and Export values are directly proportional.

- But the trade deficit increases or decreases along with

import/export values. - Except for a few instances, the change in “positive

growth”/“negative growth” is always higher in USD, when compared to

INR. It tells the USD is more sensitive than INR. - The first drop occurred after 2009 and it was recovered within one

year. - The second drop occurred around 2013 and it started recovering

from 2018. - Also there was a stagnation of import & export from the year 2013

to 2017.

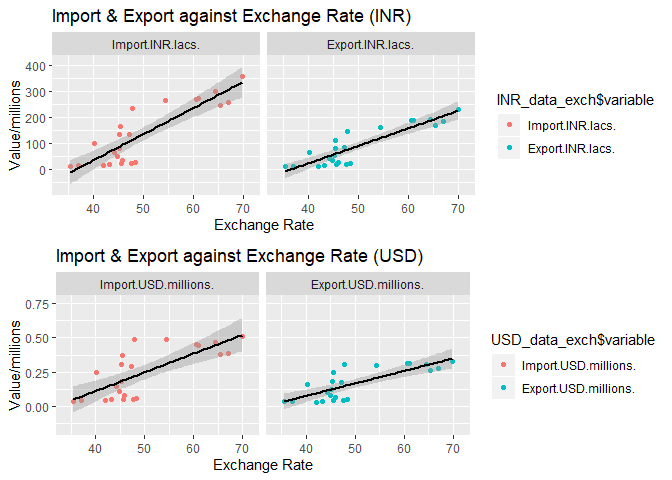

Analysis 2: Import & Export against Exchange rate

The below chart shows the import & export in USD & INR against the

exchange rate. All other variables affecting import & export were

assumed unchanged. Practically this situation is not feasible.

- Since the data points are scattered, we have added a linear

regression model to each chart. - The linear model line clearly shows that import & export are

directly proportional to the exchange rate.

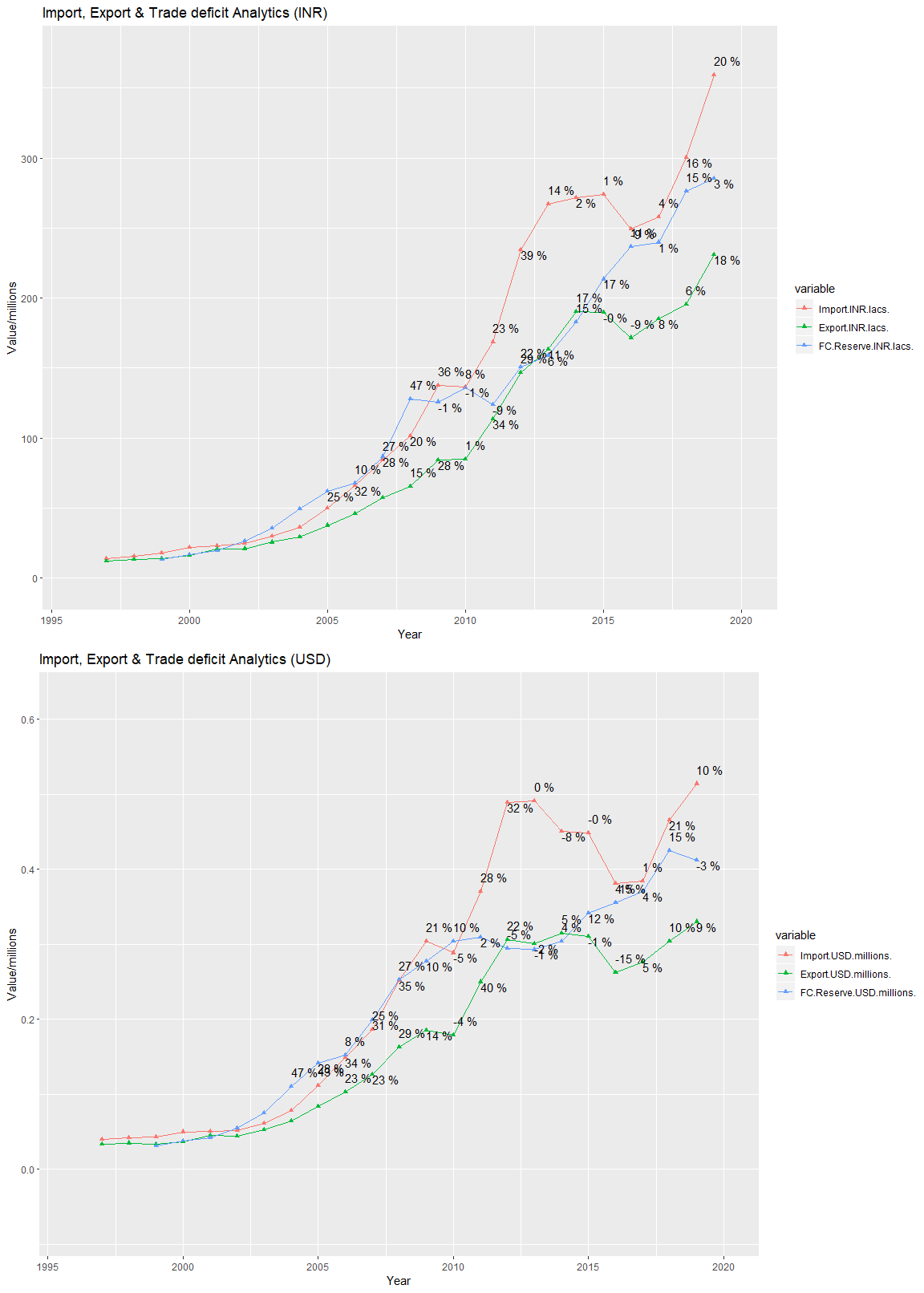

Analysis 3: Import, Export & Foreign Currency Reserve

The below chart shows the import, export & foreign curremcy reserve in

USD & INR against the year. All other variables affecting import &

export was assumed unchanged.

- The “positive/negative growth” is USD is mostly higher than INR.

- The INR chart shows a growth for the year 2012, 2013 & 2014, which

is flat in USD chart. Currency inflation could be a reason for this. - Also there was a stagnation of foreign currency reserve from the

year 2012 and it started recovering from the year 2017.

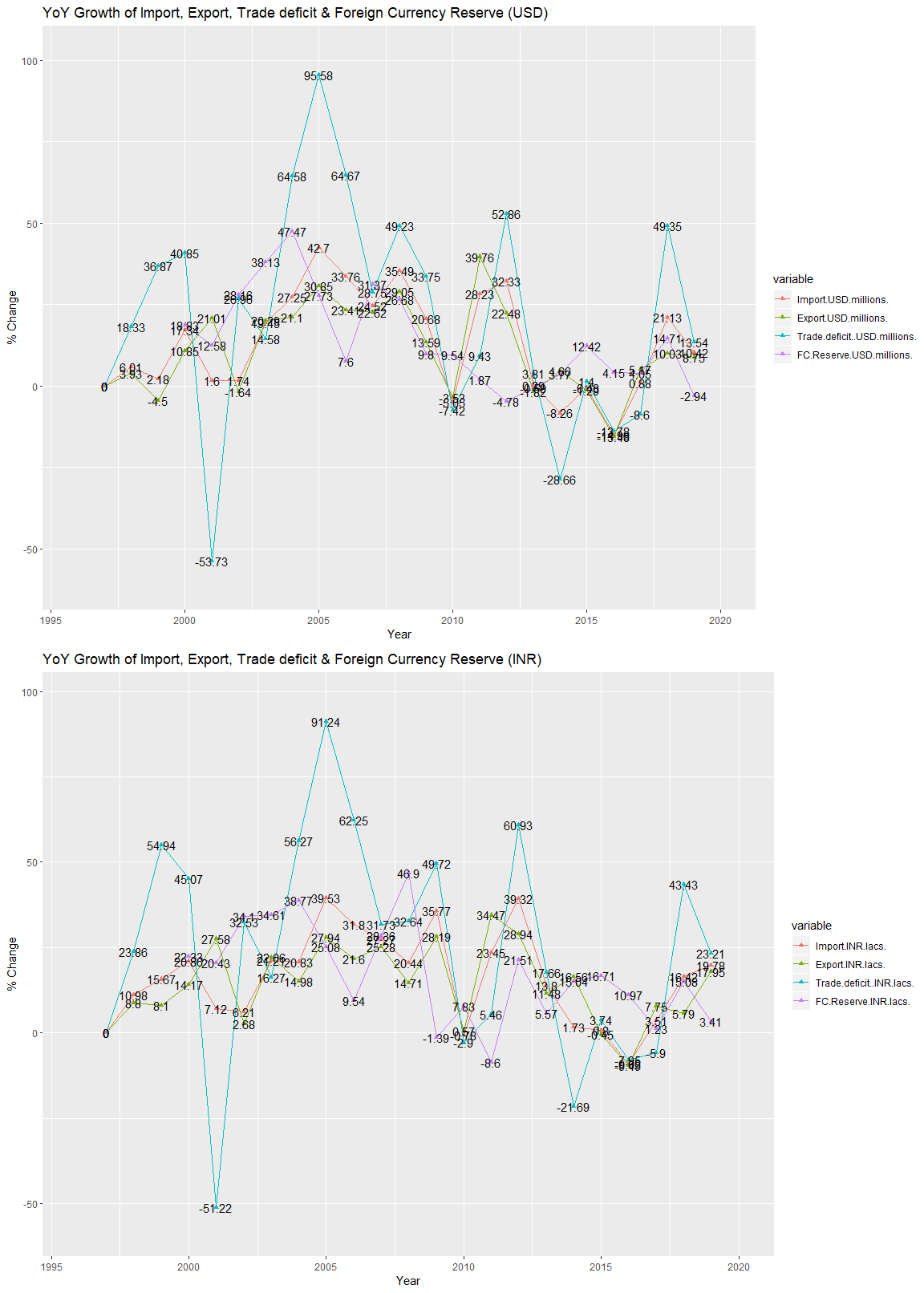

Analysis 4: Year on Year (YoY) Percentage growth of Import, Export, Trade deficit & Foreign currency reserve

The below chart shows positive/negative growth of import, export, trade

deficit & foreign currency reserve in USD & INR.

Even though both INR & USD charts look the same, the below findings

arrived from the USD chart.

- When import grows more than export, then the sensitivity of the

increase in trade deficit is more. Similarly when the import drops

more than export, then the sensitivity of the decrease in trade

deficit is more. - All variable were having negative/positive growth together for 7

years out of 19 years (from 2001 to 2019). - Always import & export drops when foreign currency reserve drops in

the previous year, except 2011 & 2012, 2017 & 2018. But this

exception may be due to the huge fall in the succeeding/preceding years 2010, 2013 & 2019.